The listings featured on this site are from companies from which this site receives compensation. This influences where, how and in what order such listings appear on this site. Advertiser Disclosure

These are some websites that we have carefully selected

Loans & Financial Services 2025.

The best online savings accounts offer high interest rates while being a great place to park your money. Because online banks don’t have the expense of maintaining branches, they can offer high-interest savings paying many times higher than the national average of 0.46%*. To make the search easier, we created this shortlist of standout picks from our partners. Check out the offers, from our partners, and start earning interest today.

Years of experience

Helped users

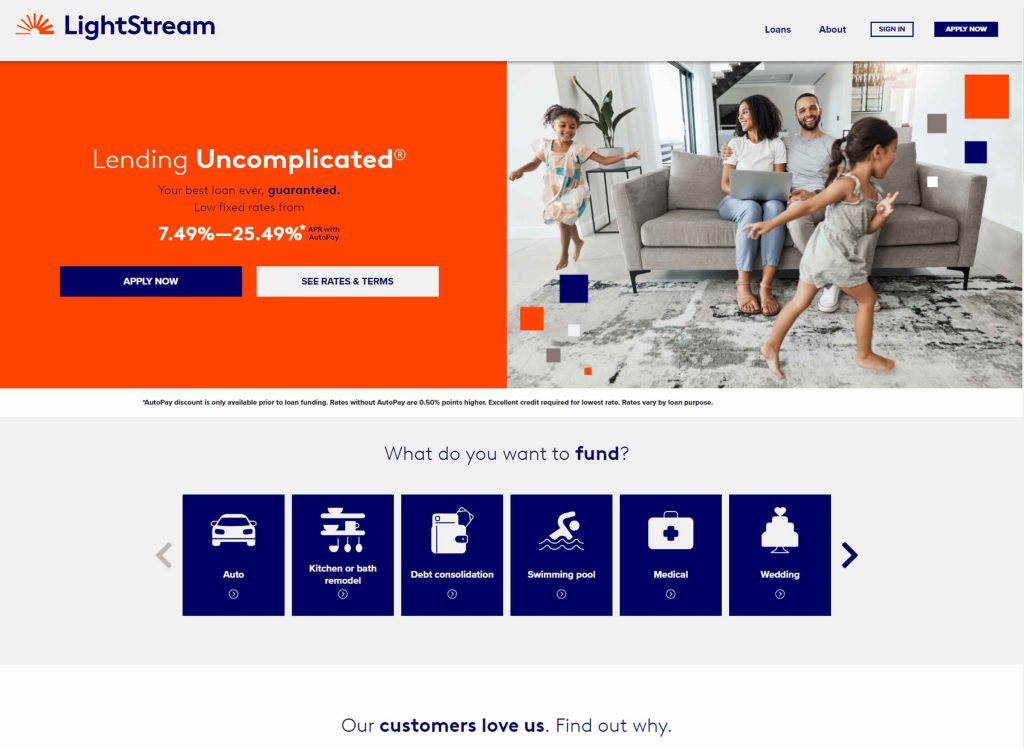

lightstream

Happy Money

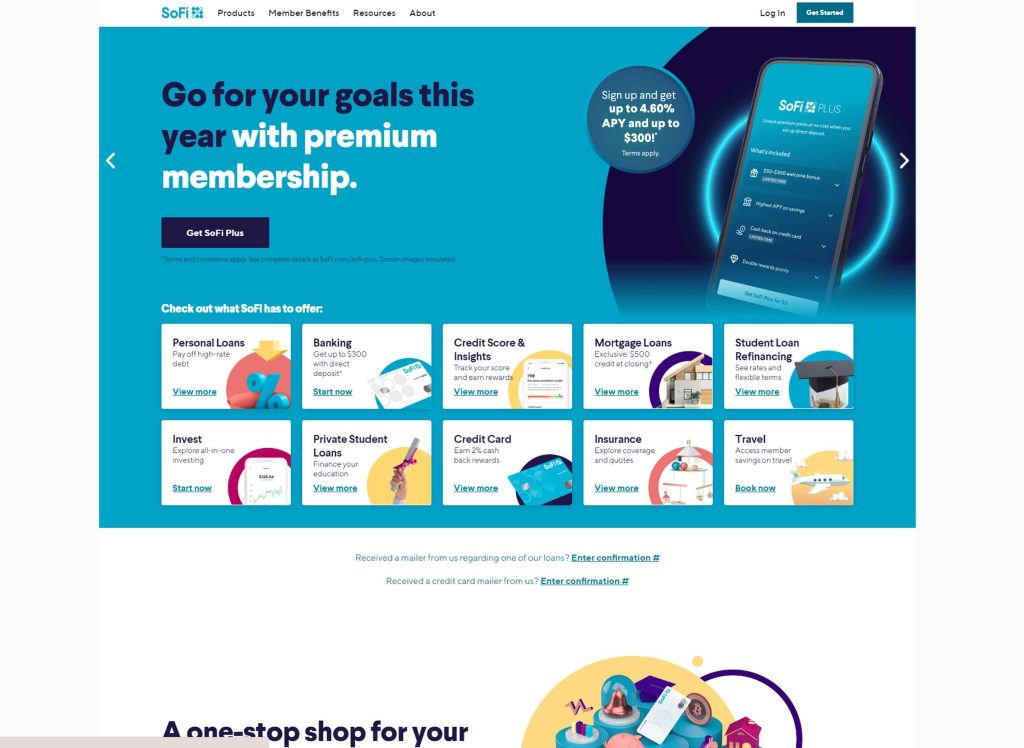

SoFi

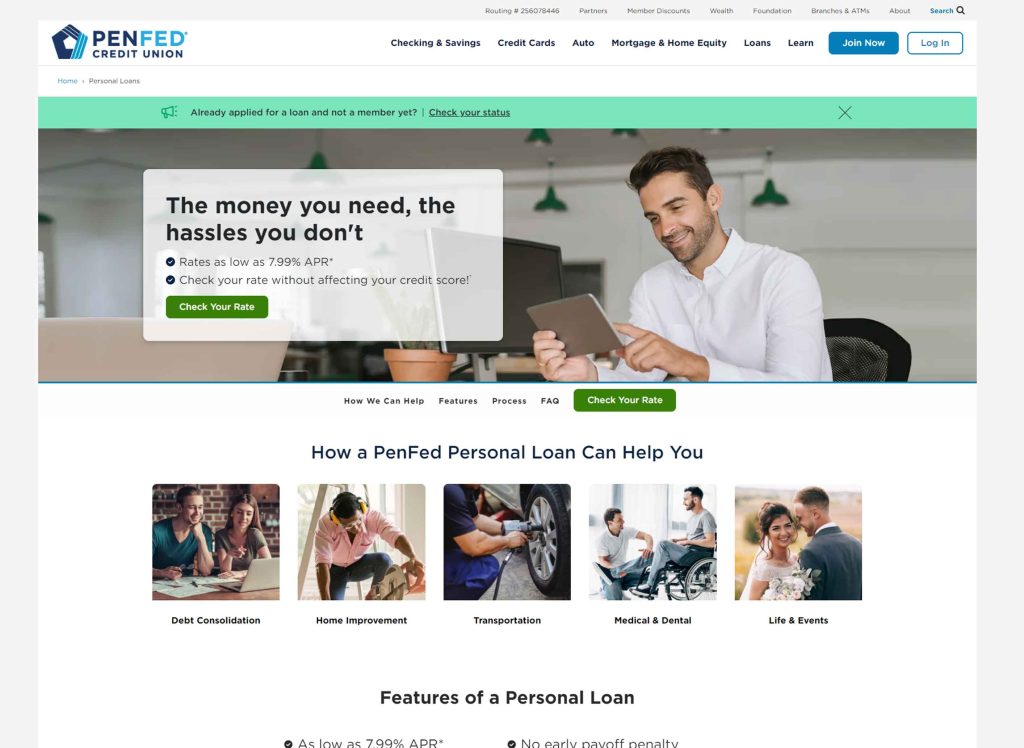

PenFed

Discover

Upstart

The specific information is as follows:

01.

- Loan amounts up to $100,000

- No origination fees, no early payoff fees, no late fees

- LightStream plants a tree for every loan

LightStream, the online lending arm of Truist Bank, offers low-interest loans with flexible terms for people with good credit or higher. LightStream is known for providing loans for nearly every purpose except for higher education and small business. You could get a LightStream personal loan to buy a new car, remodel the bathroom, consolidate debt, or cover medical expenses, according to the company’s website.

You can receive your funds on the same day, if you apply on a banking business day, your application is approved and you electronically sign your loan agreement and verify your direct deposit banking account information by 2:30 p.m. ET.

LightStream offers the lowest APRs of any lender on this list, including a discount when you sign up for autopay. Interest rates vary by loan purpose, and you can view all ranges on LightStream’s website before you apply. This is subject to change as the Fed rates fluctuate.

If you select the invoicing option for repayment, your APR will be 0.50% higher than if you sign up for autopay. The APR is fixed, which means your monthly payment will stay the same for the lifetime of the loan. Terms range from 24 to 144 months, dependent on loan purpose — the longest-term option among the loans on our best-of list.

LightStream does not charge any origination fees, administration fees or early payoff fees.

02.

- Peer-to-peer lending platform makes it easy to check multiple offers

- Loan approval comes with Happy Money membership and customer support

- No early payoff fees

A Happy Money personal loan is a good choice if you’re looking to consolidate your credit card debt and pay it down over time at a lower interest rate.

Happy Money’s mission is to help consumers get out of credit card debt once and for all, which is why its loans are geared specifically toward debt consolidation. You can’t use a Happy Money loan for home renovations, major purchases, education, etc.

Borrowers can take out loan amounts between $5,000 and $40,000, and the loan terms range from 24 to 60 months. There’s a soft inquiry tool on its website, which allows you to look at possible loan options based on your credit report without impacting your credit score.

Happy Money doesn’t charge late payment fees, or early payoff penalties if you decide to pay off your debt faster than you initially intended, but there is an origination fee based on your credit score and application. The higher your score, the lower your origination fee and interest rates are likely to be.

Unlike some lenders, Happy Money allows you to deposit the money you borrow into your linked bank account or send it directly to your creditors. Another perk you get from taking out a Happy Money loan is access to various financial literacy tools, such as free FICO score updates, a team that performs quarterly check-ins with you during your first year of working with Happy Money and tools to help members improve their relationship with money through personality, stress and cash flow assessments.

03.

- No origination fees required, no early payoff fees, no late fees

- Unemployment protection if you lose your job

- DACA recipients can apply with a creditworthy co-borrower who is a U.S. citizen/permanent resident by calling 877-936-2269

SoFi got its start refinancing student loans, but the company has since expanded to offer personal loans up to $100,000 depending on creditworthiness, making it an ideal lender for when you need to refinance high-interest credit card debt.

If you have high-interest debt on one or more card, and you want to save money by refinancing to a lower APR, SoFi offers a simple sign-up and application process, plus a user-friendly app to manage your payments.

Another unique aspect of SoFi lending is that you can choose between a variable or fixed APR, whereas most other personal loans come with a fixed interest rate. Variable rates can go up and down over the lifetime of your loan, which means you could potentially save if the APR goes down (but it’s important to remember that the APR can also go up). However, fixed rates guarantee you’ll have the same monthly payment for the duration of the loan’s term, which makes it easier to budget for repayment.

By setting up automatic electronic payments, you can earn a 0.25% discount on your APR. You can also set up online bill pay to SoFi through your bank, or you can send in a paper check.

Once you apply for and get approved for a SoFi personal loan, your funds should generally be available within a few days of signing your agreement. You can both apply for and manage your loan on SoFi’s mobile app.

While taking on a sizable loan can be nerve-wracking, SoFi offers some help if you lose your job: You can temporarily pause your monthly bill (with the option to make interest-only payments) while you look for new employment. You may still incur interest, but your payment history will remain unharmed. You can read more about SoFi’s Unemployment Protection program in its FAQs.

04.

- Credit union membership available to anyone

- Loans as low as $600

- Can pick up a physical at a branch

PenFed is a federal credit union that offers membership to the general public and provides a number of personal loan options for debt consolidation, home improvement, medical expenses, auto financing and more.

While most lenders have a $1,000 minimum for loans, you can get a $600 loan from PenFed with terms ranging from one to five years. You don’t need to be a member to apply, but you will need to sign up for a PenFed membership and keep $5 in a qualifying savings account to receive your funds.

While PenFed loans are a good option for smaller amounts, one drawback is that funds come in the form of a paper check. If there is a PenFed location near you, you can pick up your check directly from the bank. However, if you don’t live close to a branch, you have to pay for expedited shipping to get your check the next day.

Unlike some lenders, PenFed doesn’t offer a discount for autopay.

05.

- No origination fees, no early payoff fees

- Same-day decision (in most cases)

- Option to pay creditors directly

Discover Personal Loans can be used for consolidating debt, home improvement, weddings and vacations. You can receive your money as early as the next business day provided that your application was submitted without any errors (and the loan was funded on a weekday). Otherwise, your funds will take no later than a week.

While there are no origination fees, Discover does charge a late fee of $39 if you fail to repay your loan on time each month. There’s no penalty for paying your loan off early or making extra payments in the same month to cut down on the interest.

If you’re getting a debt consolidation loan, Discover can pay your creditors directly. Once you’re approved for and accept your personal loan, you can link the credit card accounts so Discover will send the money directly. You just need to provide information such as account numbers, the amount you’d like paid and payment address information.

Any money remaining after paying your creditors can be deposited directly into your preferred bank account.

06.

- Open to borrowers with fair credit (minimum 300 score)

- Will accept applicants who have insufficient credit history and don’t have a credit score

- No early payoff fees

Upstart is ideal for individuals with a low credit score or even no credit history. It is one of the few companies that look at factors beyond your credit score when determining eligibility. It also allows you to apply with a co-applicant, so if you don’t have sufficient credit, you still have the opportunity to receive a lower interest rate.

Upstart considers factors like education, employment, credit history and work experience. If you want to find out your APR before you apply, Upstart will perform a soft credit check. Once you apply for the loan, the company will perform a hard credit inquiry which will temporarily ding your credit score.

You can choose a three-year or five-year loan and borrow anywhere from $1,000 to $50,000. Plus, Upstart has fast service — you’ll get your money the next business day if you accept the loan before 5 p.m. EST Monday through Friday.

One other major draw for Upstart is that this lender doesn’t charge any prepayment penalties. However, if you’re more than 10 days late on a payment, you’ll owe 5% of the unpaid amount or $15, whichever is greater. You’ll also have to pay an origination fee of up to 12% of the loan amount.

Frequently Asked Questions

What are rates on personal loans?

Personal loan annual percentage rates range from 6% to 35.99%, but your rate depends on a number of factors, including your credit score. Borrowers with a good credit score (690 or higher) can expect an APR of around 15% or lower. If you have fair to bad credit (689 or less), APRs can start around 20%. A good rate on your loan is one that is cheaper than other available credit options. Track average personal loan rates.

How long does it take to get a personal loan?

Some lenders can approve your loan application within minutes, and you may receive funds the same or next day after approval. Multiple factors impact how long it takes to get a personal loan.

Where can I apply for a personal loan?

You can apply for a personal loan at a bank, a credit union or an online lender. Most offer online applications, but you can complete a physical application at some credit unions and banks.

How much is a personal loan?

The annual percentage rate will tell you how much your loan will cost. The APR is a combination of your interest rate and fees, and is based on multiple factors like your credit score, loan term and the lender you choose. A personal loan calculator can show you a loan’s total cost.

What is a loan term?

The loan term is the length of time you have to repay the loan. Personal loan lenders provide the money as a lump sum at the start of the term, and borrowers typically have two to seven years for repayment.

Can I get a personal loan with bad credit?

Credit score requirements vary among personal loan lenders. Some lenders accept borrowers with good or better credit only; others will loan to bad-credit borrowers. Learn how to get a loan with bad credit.

Introduction to Loans and Financial Services

What is a personal loan?

A personal loan is money borrowed from a bank, a credit union or an online lender that you repay in equal monthly installments, usually over two to seven years.

Personal loans are typically unsecured, which means they don’t require collateral. Lenders instead consider your credit profile, income and debts during the loan approval process. If you fail to repay the loan, your credit can take a hit.

How do personal loans work?

Within a few days after you’re approved for a personal loan, a lender will deposit the funds, minus any origination fee, in a lump sum into your bank account. Once you have the money, you can use it for nearly any purpose.

Repayment typically starts 30 days after receiving the money. You can pay the fixed monthly amount directly, or some lenders let you set up auto-pay from your bank account. The monthly payments continue until the loan term ends, or earlier if you make additional payments toward your loan. The personal loan is over once you have paid it off in full.

When should I get a personal loan?

A NerdWallet survey published in October 2023 revealed that nearly 29% of Americans took out a personal loan within the past 12 months, borrowing on average $6,299.

Getting a personal loan makes the most sense when:

It’s the least expensive form of financing.

It’s used to potentially increase your financial standing, like debt consolidation or home improvements.

You can manage the monthly payments without stressing your budget.

Reasons to get a personal loan

Personal loans can be used for almost any purpose. Some common reasons borrowers get a loan include:

Debt consolidation.

Home improvement.

Major life events.

Medical expenses.

Unexpected expenses.

Using a personal loan for a wedding or discretionary expenses like a vacation can be expensive. NerdWallet recommends using savings for nonessentials to avoid finance charges.

If you’re borrowing for emergency or medical expenses, consider less-expensive alternatives, such as community assistance or payment plans.

Pros and cons of personal loans

Depending on your financial situation and the loan’s purpose, a personal loan can be the right move or one you should sidestep.

Pros

Lower starting APRs than credit cards. For consumers with strong credit, personal loans typically have lower APRs than credit cards. While some credit cards offer 0% interest during an introductory period, the rates are generally higher after the period ends.

» MORE: Personal loans vs. credit cards: What’s the difference?

Fixed rates and monthly payments. Personal loans have fixed rates and monthly payments over a set term, so you always know what you owe and for how long. Other financing options like home equity lines of credit have variable rates that can mean fluctuating monthly payments.

Flexible loan amounts. Depending on the lender and your creditworthiness, you may have access to personal loan amounts of $1,000 to $100,000. This range meets a wide variety of expenses, from small emergencies to large home improvement projects.

No collateral. Unlike home equity loans that require you to secure the loan with your house, unsecured personal loans don’t require collateral. You risk damaging your credit if you can’t repay, but you won’t lose any assets.

Cons

Maximum APRs can be high. If you have a low credit score, APRs on personal loans can be higher than credit card APRs.

Possible fees. Borrowers may have to pay fees — like origination or late fees — along with their loan payments.

Increase in debt. Taking a personal loan adds debt to your budget, so it’s important to factor in the additional obligation and feel comfortable about paying it off.

Best place to get a personal loan

You can get a personal loan from online lenders, banks and credit unions. The best option depends on where you can get the rate, terms and features that fit your financial situation.

For example, if a fast and convenient loan application is important to you, then consider an online lender. On the other hand, if lower rates and in-person support matter, then a bank loan or credit union loan could be the better option.

How to choose the best personal loan

Here are things to consider as you shop around and compare personal loans.

Soft credit check. Most online lenders let you check your estimated interest rate by performing a soft check of your credit during pre-qualification. This won’t affect your credit score, so it pays to take steps to pre-qualify for a loan with multiple lenders and compare rates and loan features.

Annual percentage rates. Because APRs include interest rates and fees, they offer an apples-to-apples cost comparison for borrowers deciding between personal loan offers. Use our personal loan calculator to see monthly payments and total costs on personal loans.

Funding time. The time it takes to get a personal loan can depend on the type of lender. Many online lenders will approve your application and send funds the same or next day after you apply. Banks and credit unions may take up to a week.

Repayment terms. Having a wide variety of repayment term options gives you the option to get a shorter term and pay less interest or a longer term and have a low monthly payment. Based on your budget, one may make more financial sense than the other.

Loan amount. Depending on how much money you need, one lender could be more attractive than another. Some lenders offer small to midsize loan amounts, like $2,000 to $50,000, while others provide loans up to $100,000. Determining the amount you need will help you compare and decide.

Special features. See if the lender you’re considering offers any perks that could help you reach your financial goals. You may benefit from features like autopay rate discounts, unemployment protection or financial coaching.

How to get a personal loan

Review your credit. Your credit score is a primary factor in whether you qualify for a personal loan and the rate you receive. Resolve any errors that might be hurting your score and, if you can, pay down debts to reduce your DTI ratio. Get a free credit report with NerdWallet or at AnnualCreditReport.com.

Pre-qualify with multiple lenders. Pre-qualifying gives you an idea of the rate and terms you can expect. Compare pre-qualified offers to find the lowest APR and monthly payments that fit your budget.

Apply. The formal application process requires documents to verify your identity and income. Once approved, you’ll typically receive your loan funds within a week.